Global Wine Production Declines Over 4% in 2024 Amid Climate Shocks

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Global Wine Production Slowed by Climate Shocks, OIV Reports

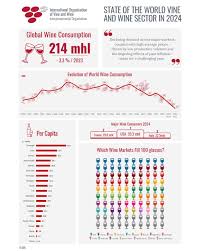

In a stark reminder that the climate crisis is already reshaping the world’s most celebrated industries, the International Organisation of Vine and Wine (OIV) released its latest Wine Market Report on Thursday, revealing that global wine output fell by more than 4 % in 2024 – the steepest decline since the post‑war era. The report attributes the slump to a succession of extreme weather events – from California’s crippling drought and France’s heatwave to Australia’s late‑season frosts – and underscores the mounting pressure that climate change is placing on grapevines across the world.

A Global Decline that Hits Every Major Producer

The OIV’s statistics show that world wine production dropped from 280 million hectolitres (hl) in 2023 to 268 million hl in 2024 – a fall of 4.2 %. The decline is not isolated to a single region:

- Europe – the continent’s wine output fell 3.6 % in 2024. France, a longstanding powerhouse, saw a 4.8 % dip, with the Bordeaux region recording the most significant loss of 5.1 %. Italy’s production was down 3.2 %, largely due to unseasonably cold temperatures in the Veneto and Emilia‑Romagna zones.

- United States – California, which produces roughly 40 % of U.S. wine, recorded a 6 % drop, a consequence of the longest drought on record combined with an intense summer heatwave that pushed many vineyards toward the brink of water stress.

- Australia – a 5 % decrease was recorded, as the country faced an early frost that damaged grapes in the Barossa and Margaret River regions, and an extended dry spell that forced many growers to cut back on yields.

- South America – both Chile and Argentina suffered 4 % and 3.5 % declines, respectively, from drought and a late‑season hailstorm that devastated the Valle de Colchagua.

- Africa – South Africa’s wine output fell 3 % after a severe heatwave in the Cape Winelands region led to a 15 % reduction in grape maturity.

Even smaller producers were not spared. New Zealand’s output dipped 3 % following a cold snap in the Marlborough region that halted the ripening of Sauvignon Blanc and Pinot Noir.

The Weather Events that Shook the Industry

The OIV identifies three key climatic disturbances as primary drivers of the 2024 downturn:

California’s Drought – The drought, which began in 2021, intensified during the 2024 growing season, forcing growers to rely on expensive irrigation pumps. In 2024, water‑use restrictions were imposed across 75 % of California’s vineyards, resulting in an average yield reduction of 12 % across the state.

Heatwave in France – An all‑season heatwave broke records in Bordeaux and the Rhône valley, raising vineyard temperatures above 35 °C for weeks. The high temperatures accelerated sugar accumulation while delaying acidity development, leading to “hot” wines that required costly rebalancing and, in some cases, were deemed uncommercialisable.

Late‑Season Frost in Australia – In October 2024, an unexpected frost swept across the Barossa Valley and Margaret River, damaging the fruit’s outer tissues and effectively halving the potential yield of many vineyards.

The OIV added that these events are just the latest chapter in a series of climate shocks that have rattled the wine industry for the past decade. The report warns that the frequency and intensity of such events are projected to increase as global temperatures rise.

Economic Fallout and Market Dynamics

The decrease in volume had a direct knock‑on effect on wine prices. Across major markets, the average price per hectolitre rose by 3 % in 2024, with premium segments experiencing a 5 % increase. While higher prices can benefit producers, the rise also strained consumers, especially in price‑sensitive markets such as the United States and China.

OIV analysts note that the drop in volume will likely shift global trade patterns. Countries that experienced less severe weather – notably Portugal, Spain’s lesser‑known wine regions, and parts of Central America – are projected to become larger export players in 2025. Conversely, producers in traditionally dominant regions such as France, Italy, and California may need to diversify their markets or intensify their marketing efforts to offset the lower volumes.

Adaptation Measures on the Horizon

The OIV report emphasizes that the wine sector is beginning to adopt a suite of adaptive strategies to mitigate climate impacts:

- Irrigation Efficiency – California’s vineyards are investing in drip irrigation and water‑storage systems that reduce water use by up to 30 %.

- Cultivar Selection – Growers in Australia and Chile are increasingly planting heat‑tolerant varieties such as Grenache and Malbec. In Spain, research into early‑maturing grapes like Tempranillo is gaining traction.

- Precision Agriculture – Use of drones, satellite imagery, and soil‑moisture sensors is helping vintners detect stress early and optimise resource allocation.

- Policy Support – Several governments, including France and Australia, are introducing subsidies for climate‑resilient infrastructure and offering grants for research into disease‑resistant grapevines.

“Without a concerted effort from the private sector, academia, and governments, we’ll see a permanent shift in the geography of wine production,” says Dr. Marie‑Louise Leclerc, OIV’s climate resilience lead. “The 2024 data should be a wake‑up call for all stakeholders.”

Looking Ahead: 2025 Outlook

While the OIV forecasts a modest rebound in 2025, it warns that global wine output is still projected to remain below 2023 levels. The report cites projected average temperatures in key regions rising by 1.2 °C, combined with an increased probability of extreme events. As a result, the wine industry faces a “new normal” where yield volatility, price fluctuations, and market redistribution become routine.

In the words of OIV’s CEO, “Climate change is not a distant threat; it is a present reality that is reshaping vineyards, economies, and cultures. The 2024 report is a stark reminder that the wine industry must accelerate adaptation or risk losing a heritage that has endured for millennia.”

Final Thoughts

The OIV’s 2024 Wine Market Report paints a sobering picture: climate shocks have already curtailed global wine production by a magnitude that rivals historical downturns. Yet, it also illustrates a sector in flux – one that is innovating, collaborating, and adapting to survive. For consumers, the trend hints at higher prices and changing wine landscapes; for growers, it signals the urgency of resilient practices. Whatever the future holds, the wine industry will need to reconcile centuries of tradition with the science and urgency of climate adaptation.

Read the Full socastsrm.com Article at:

[ https://d2449.cms.socastsrm.com/2025/11/12/global-wine-output-subdued-by-climate-shocks-oiv-says/ ]