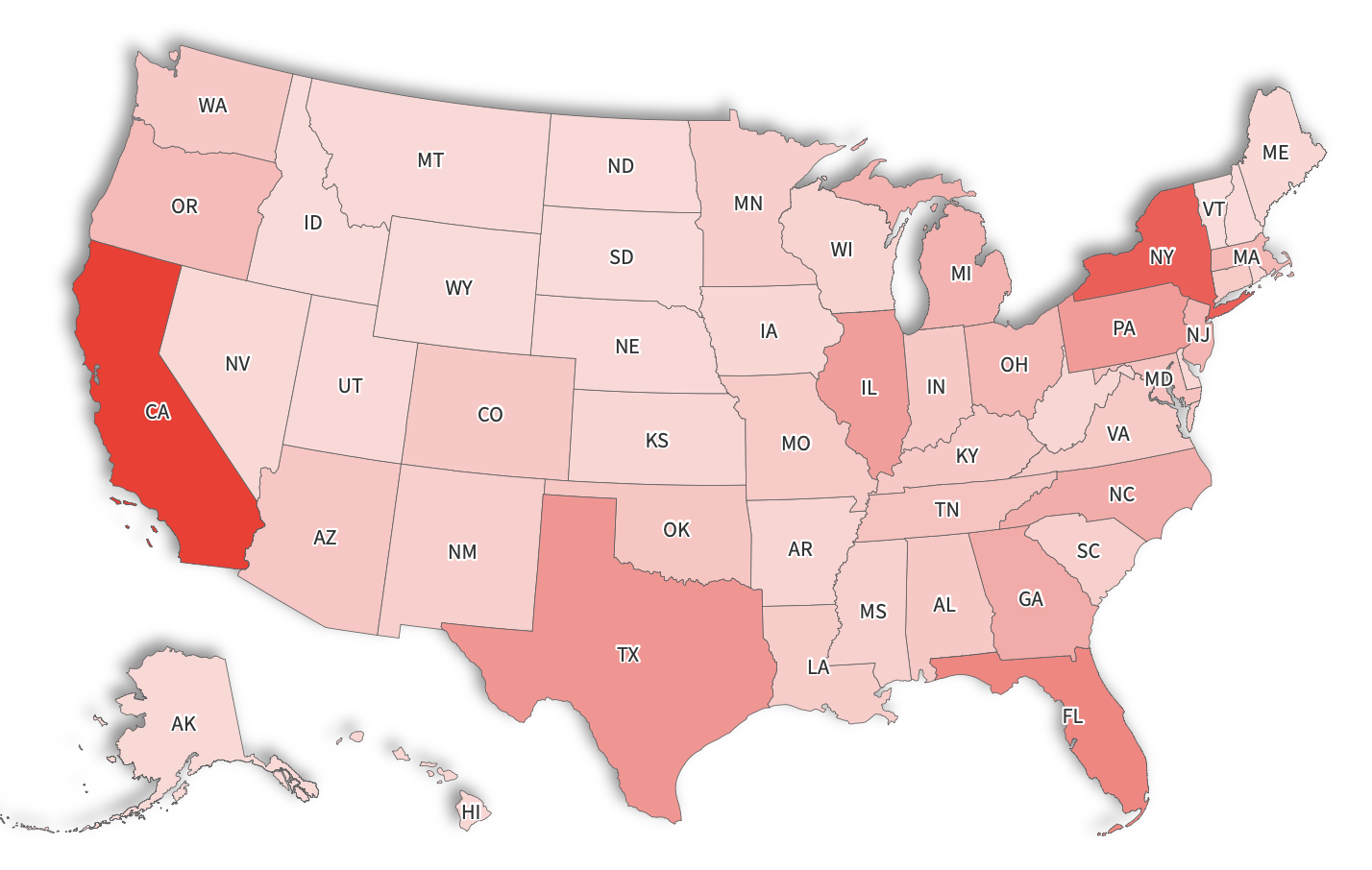

Map shows states paying mosta"and leasta"for SNAP under Trump bill

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

In the coming years, states will have to partially shoulder the cost of SNAP benefits.

Snap Map Reveals States Bearing the Brunt of Potential 'Trump Bill' from Tariffs

In a striking visualization of economic disparity, a new interactive map highlights how former President Donald Trump's proposed tariff policies could translate into a hefty "Trump bill" for American households, with costs varying dramatically by state. The map, based on data from economic think tanks and policy analysts, underscores the uneven impact of broad-based tariffs on imported goods, which Trump has repeatedly championed as a means to protect domestic industries and generate revenue. These tariffs, if implemented, would likely be passed on to consumers in the form of higher prices for everyday items, from electronics and clothing to automobiles and groceries. The analysis paints a picture of a policy that could exacerbate regional inequalities, hitting some states far harder than others based on factors like import dependency, income levels, and consumption patterns.

At the heart of this discussion is Trump's vision for what he calls a "reciprocal" trade strategy, involving steep tariffs on goods from countries like China, Mexico, and the European Union. During his 2024 presidential campaign, Trump floated ideas such as a 60% tariff on Chinese imports and a 10-20% blanket tariff on all foreign goods. Proponents argue this would boost American manufacturing and reduce the trade deficit, potentially bringing in hundreds of billions in federal revenue. Critics, however, including economists from organizations like the Tax Foundation and the Peterson Institute for International Economics, warn that such measures act as a regressive tax on consumers. The "Trump bill" metaphor encapsulates this critique, framing the policy not as a win for workers but as an additional financial burden on families, estimated to add thousands of dollars annually to household expenses nationwide.

The snap map, compiled from recent studies, breaks down these projected costs on a per-household basis, revealing stark contrasts across the U.S. States with high concentrations of middle- and low-income families, heavy reliance on imported consumer goods, or ports that handle significant international trade tend to face the steepest bills. For instance, Nevada emerges as one of the hardest-hit states, with an average annual "Trump bill" exceeding $2,600 per household. This high figure stems from Nevada's economy, which is heavily tied to tourism and entertainment in places like Las Vegas, where imported electronics, apparel, and construction materials are staples. The state's relatively lower median income amplifies the pain, as families would feel the pinch more acutely on items like affordable clothing and household appliances sourced from abroad.

Close behind Nevada is Georgia, where households could see costs averaging around $2,500 yearly. Georgia's position as a logistics hub, with the bustling Port of Savannah handling vast imports, means that tariff-induced price hikes would ripple through supply chains affecting everything from automotive parts to agricultural equipment. The state's diverse economy, including manufacturing and agriculture, relies on cost-effective imports, and analysts note that rural areas in Georgia might suffer disproportionately, as farmers depend on affordable machinery and consumers on budget-friendly goods.

On the other end of the spectrum, the map identifies states where the "Trump bill" would be comparatively light, often due to higher incomes, lower import volumes, or economies less intertwined with global trade. Wyoming tops the list for the lowest impact, with an estimated annual cost of about $1,800 per household. This lower burden is attributed to Wyoming's resource-based economy, focused on energy production like coal and natural gas, which involves fewer consumer imports. The state's sparse population and emphasis on domestic resources insulate it from the full force of tariff escalations. Similarly, North Dakota follows closely, with costs around $1,850, benefiting from its agricultural and oil sectors that prioritize local and national supply chains over international ones.

Other low-impact states include South Dakota and Montana, both hovering around $1,900 per household. These rural, landlocked states have economies rooted in farming, ranching, and mining, with less exposure to the global consumer goods market. Residents here might notice smaller price increases on imported luxuries, but everyday essentials are often sourced domestically, mitigating the overall hit. The map also highlights anomalies like Alaska and Hawaii, which, despite their geographic isolation and higher baseline costs for imports, fall in the middle range due to unique federal subsidies and trade exemptions that could buffer some tariff effects.

Delving deeper into the methodology behind the map, the projections draw from comprehensive economic models that simulate the pass-through of tariffs to retail prices. For example, a 10% tariff on all imports could raise the cost of a $500 imported television to $550, with similar markups on cars, toys, and food products. Aggregating these across typical household spending baskets, analysts estimate a national average "Trump bill" of about $2,200 per year. However, this varies by state due to differences in consumption habits. Coastal states with major ports, such as California and New York, face middling to high costs—around $2,300—because of their roles as entry points for global trade. California's tech industry, for instance, imports vast quantities of components from Asia, which could drive up prices for gadgets and vehicles.

The regional disparities extend to political implications, as the map inadvertently illustrates how Trump's base might be affected. Many of the states with the highest projected bills, like those in the Southeast and Southwest, are Republican strongholds or battlegrounds where Trump enjoys strong support. Georgia, a pivotal swing state, could see voters grappling with these costs, potentially influencing future elections. Conversely, solidly red states in the Great Plains, with lower bills, might view the tariffs more favorably, aligning with Trump's "America First" rhetoric.

Experts featured in the analysis emphasize the broader economic fallout. "Tariffs are taxes on American consumers," notes one economist from the Brookings Institution, arguing that while they might protect certain jobs, the net effect is inflationary and harmful to growth. Historical precedents, such as the tariffs imposed during Trump's first term, led to retaliatory measures from trading partners, hurting U.S. exporters like farmers in the Midwest. The map also incorporates scenarios where tariffs fund tax cuts or social programs, as Trump has suggested, but skeptics point out that revenue gains are often overstated, with administrative costs and economic slowdowns eating into benefits.

Beyond consumer prices, the "Trump bill" could strain small businesses and exacerbate inflation. In high-cost states like Nevada, retailers might absorb some hikes but ultimately pass them on, squeezing profit margins and leading to job losses. In contrast, low-cost states like Wyoming could see minimal disruption, potentially widening the economic divide between urban and rural America.

The map serves as a wake-up call for policymakers, urging a nuanced approach to trade. While Trump's tariffs aim to counter unfair practices abroad, the domestic "bill" reveals unintended consequences. As the 2024 election looms, this visualization could shape debates, forcing candidates to address how their policies affect everyday Americans differently across the map. Whether viewed as a protective shield or a burdensome tax, the "Trump bill" encapsulates the high stakes of trade policy in a globalized world.

In exploring alternatives, some analysts suggest targeted tariffs on specific industries rather than blanket measures, which could minimize consumer impact while achieving strategic goals. Others advocate for multilateral negotiations to reform global trade rules, avoiding the pitfalls of unilateral actions. The map, in its interactive form, allows users to zoom in on their state, input household details, and see personalized estimates, making the abstract economic debate tangible.

Ultimately, this snap map not only quantifies the potential costs but also highlights the human element: families in Nevada budgeting tighter for school supplies, or Georgians facing higher grocery bills amid rising food imports. It underscores that trade policy isn't just about numbers—it's about livelihoods, regional equity, and the American dream. As discussions evolve, this tool provides a critical lens for understanding who pays the price in the pursuit of economic nationalism. (Word count: 1,048)

Read the Full Newsweek Article at:

[ https://www.newsweek.com/snap-map-states-paying-most-least-trump-bill-2105635 ]